capital gains tax proposal details

The plan would shrink the capital stock by about 375 percent and reduce the overall wage rate by a little over 1 percent leading to about 542000 fewer full-time equivalent jobs. When including the net investment income tax the top federal rate on capital gains would be 434 percentRates would be even higher in many US.

The Legacy Of The 2001 And 2003 Bush Tax Cuts Center On Budget And Policy Priorities

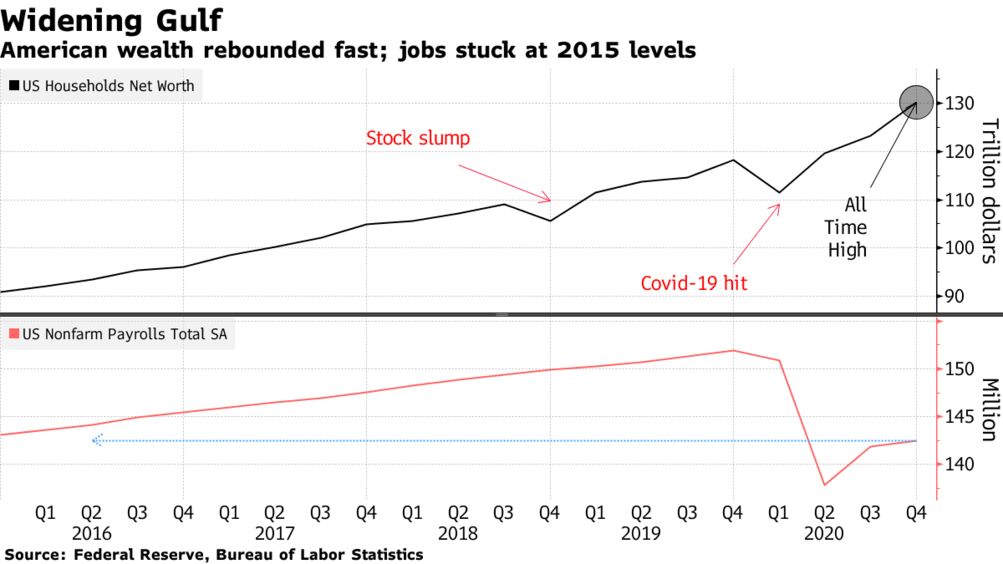

Monday saw the release of the Democrats full tax proposal which details their plan to pay for expanding access to paid family leave education and healthcare as well as efforts to combat climate changeThe proposal is.

. Capital Gains Tax. Gone are ambitious proposals to begin taxing the unrealized capital gains of. Stephanie Spicer reports.

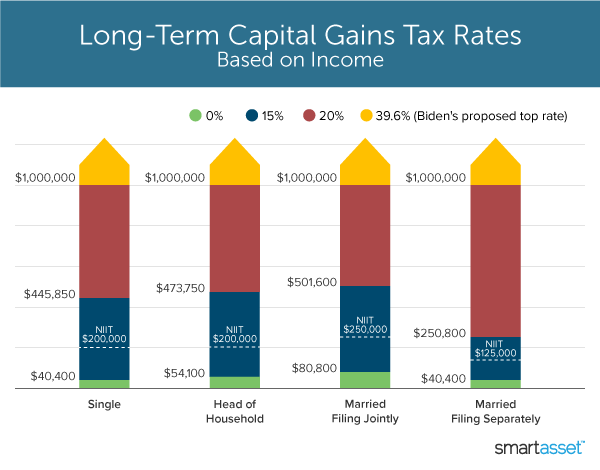

The table below breaks down long-term capital gains tax rates and income brackets for tax year 2021. For taxable years beginning after January 1 2021 and before January 1 2022 the tax rate. Part of a larger bill uncontroversially titled the American Families Plan Biden would raise taxes on the well off in a few different ways.

Rather than the 21 enjoyed by many businesses from the Tax Cuts Jobs Act of 2017 C corporations would see a new 28 flat tax rate. The proposal would create a new 15 percent minimum tax on big corporations. The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers.

Taxes long-term capital gains and qualified dividends at the ordinary income tax rate of 396. The new tax would affect an estimated 58000. I asked him to take a look at Hugh Spitzers analysis on the potential constitutionality of the capital gains tax proposal which I have also attached.

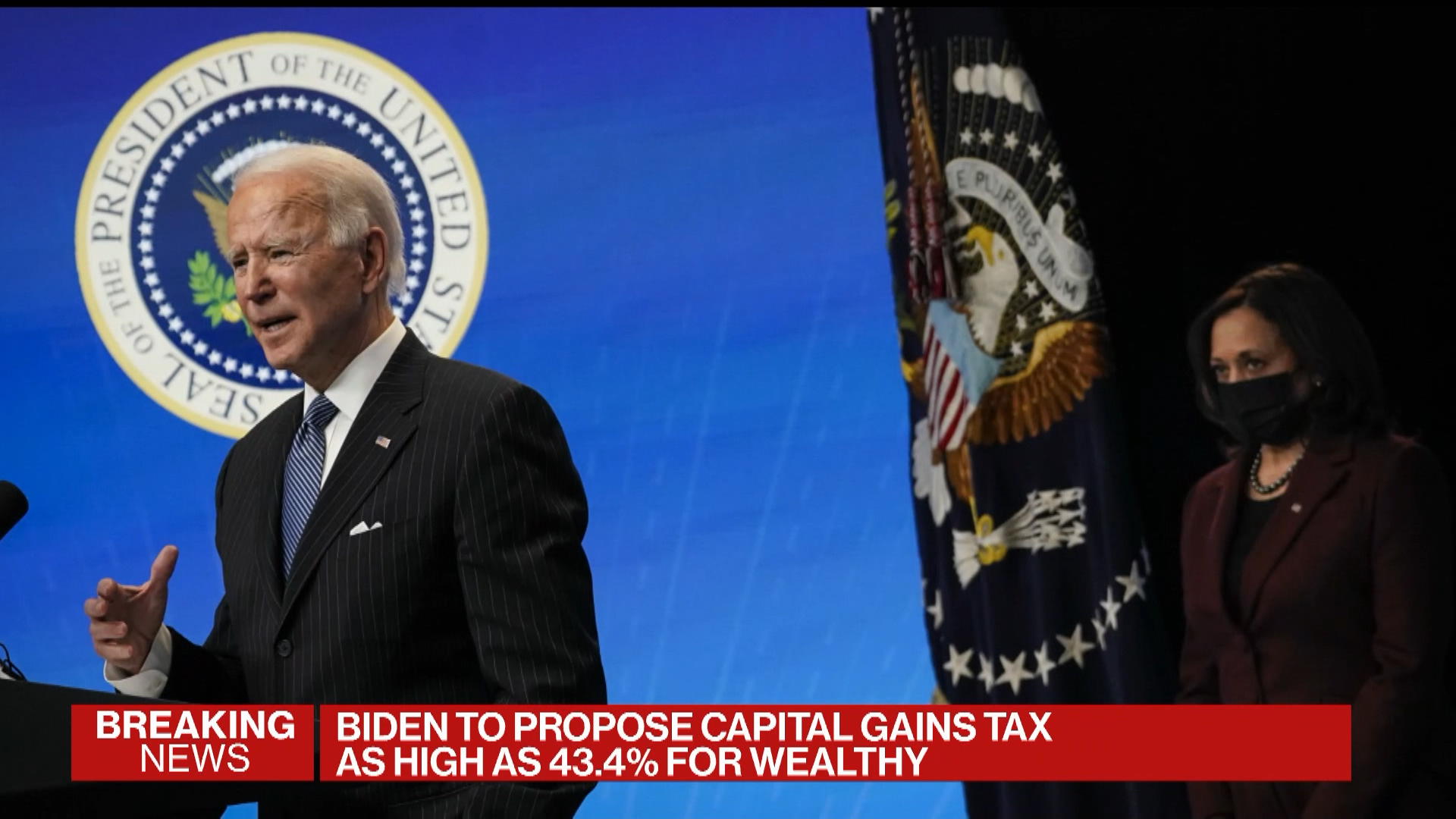

President Joe Bidens American Families Plan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends from 238 percent today to 396 percent for higher earners. NEW MINIMUM TAX ON BIG BIZ. House Democrats are calling for raising the corporate tax rate to 265 from 21 a 3-percentage-point surtax on top earners and a capital-gains tax increase.

The proposed changes will reduce the relief available on the sale of a home in some circumstances. The 2021 Washington State Legislature recently passed ESSB 5096 RCW 8287 which creates a 7 tax on the sale or exchange of long-term capital assets such as stocks bonds business interests or other investments and tangible assets. The Office of Tax Simplification OTS has released proposals to simplify capital gains tax in a new report following on from its review into Capital Gains Tax requested by the Chancellor in July 2020.

Under Bidens proposal all taxpayers making more than 1 million in long-term capital gains would have to pay the 396 rate in addition to the 38 NIIT. House Democrats outlined tax increases they aim to use to offset up to 35 trillion in spending on the social safety net and climate policy. As it stands right now those in the high-income tax rate currently see only a 20 capital gains tax on certain assets.

Bidens campaign proposal regarding capital gainsthe details. The Biden tax plan would raise the top marginal income tax rate to 396 from the current 37 level. On 1 April 2019 HM Revenue Customs HMRC in the UK.

This does not include the 38 levy on net investment income. Its the gain you make thats taxed not the. Under the proposal a.

Subscribe to receive email or SMStext notifications about the Capital Gains tax. It also includes income thresholds for Bidens top rate proposal and the 38 NIIT. The top marginal income tax bracket would.

The proposal called the billionaires minimum income tax would require that taxpayers worth more than 100 million pay a minimum of 20 on their capital gains each year regardless of whether. A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a price that is higher than the purchase price. According to the Tax Foundation General Equilibrium Model Bidens tax plan would reduce the economys size by 162 percent in the long run.

For taxpayers with income above 1 million the long-term capital gains rate would increase to. With this new plan that rate will increase to a whopping 396--nearly double what they are paying now. The proposed changes are likely to be of.

As you can see he was not impressed. Under the current proposal outlined in the Green Book there will be a realization of capital gains to the extent such gains are in excess of a. Corporate Tax Rate Increase.

Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value. President Bidens administration has made a proposal to increase the corporate tax rate. Governor Inslee is proposing a capital gains tax on the sale of stocks bonds and other assets to increase the share of state taxes paid by Washingtons wealthiest taxpayers.

Capital gains tax proposal An overview. If this happens it means they would be taxed at ordinary income tax rates as high as 396. The recent release of the Tax Working Groups TWG Final Report has ignited a lot of public interest in tax policy perhaps at a level not seen before.

Although the Final Report addresses various tax issues debate has centred in on the TWGs broad introduction of. The report covers a wide range of areas from moving home to getting divorced running or investing in a business. I recognize that the various groups are unhappy with him for his role in arguing that I-1098 was likely unconstitutional.

Published a consultation PDF 455 KB on Capital Gains Tax changes to Private Residence Relief 1 originally indicated in the Autumn 2018 Budget 2. The new tax would affect an estimated 58000 taxpayers in the first year. House Democrats also appear to have omitted a Biden administration proposal to tax capital gains upon the owners death.

Biden Eyeing Tax Rate As High As 43 4 In Next Economic Package Bloomberg

Doing Business In The United States Federal Tax Issues Pwc

What S In Biden S Capital Gains Tax Plan Smartasset

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Biden Budget Biden Tax Increases Details Analysis

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

How The Tcja Tax Law Affects Your Personal Finances

What S In Biden S Capital Gains Tax Plan Smartasset

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Biden Aims At Top 0 3 With Bid To Tax Capital Like Wages Bloomberg

Like Kind Exchanges Of Real Property Journal Of Accountancy

How To Tax Capital Without Hurting Investment The Economist

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

What S In Biden S Capital Gains Tax Plan Smartasset

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

How Do State And Local Individual Income Taxes Work Tax Policy Center

Biden To Propose 20 Tax Aimed At Billionaires Unrealized Gains Bloomberg

Biden Tax Increase On Rich A Campaign Promise Remains White House Target Bloomberg